Budgeting With a Twist™

Experience a new approach to budgeting that works around your income, not against it.

Income-First Planning

Build budgets around when you get paid, not arbitrary months.

Zero-Based Budgeting

Every dollar has a purpose with our intelligent budget planner.

Smart Tracking

Real-time expense tracking with bank sync capabilities.

Custom Categories

Tailor your budget to fit your unique lifestyle and goals.

Discover how Budgetocity can transform your financial planning

Unlock Powerful Tools for Better Budgeting

Take your budgeting to the next level with our premium tools. Get exclusive features designed to give you more control over your finances and help you achieve your financial goals faster.

Share Your Budget

Collaborate with family, friends, or financial advisors by sharing your budget in real time. Perfect for households or joint finances.

Tag and Organize Transactions

Stay organized by tagging your expenses and categorizing them easily. With our intuitive system, quickly group your spending and identify areas for improvement.

AI Budget Assistant

Use AI to quickly find your transactions in seconds. The AI-powered tool scans your spending, helping you effortlessly track purchases and identify spending patterns.

Create Savings Goals

Set and track your savings goals with ease. Whether it's for an emergency fund, vacation, or major purchase, our tool helps you stay focused and motivated.

Ready to upgrade your budgeting experience?

Unlock all premium features for just $4.99/month and take full control of your finances.

Budgetocity Plans

Pricing that fits your budget

Premium

$4.99/month

- Create Your Plan

- Build Your Budget

- Track Spending

- Customize Categories

- Create Savings Plans

- Advanced Transaction Search

- Tag/Organize Transactions

Learn

Want to learn how to take control of your finances?

Explore our paycheck budgeting blog and learning tracks for clear, step-by-step answers.

Latest Post

Bi-Weekly Budget Template: How to Build One That Actually Works

A bi-weekly budget template assigns every expense to the paycheck that covers it. Here is how to build one that matches your real pay schedule and eliminates money stress.

Learning Track

Paycheck-to-Paycheck Basics

A step-by-step learning track to budget by paycheck, stop the scramble, and build steady control over your money.

Built for U.S. pay cycles where rent, utilities, and everyday costs hit between weekly or bi-weekly paychecks.

Why Do You Budget?

Select your financial goal and discover how Budgetocity can help you achieve it. We'll show you relevant features, tips, and resources tailored to your situation.

Not sure which applies to you? Start with our free plan and explore at your own pace.

Get Started FreeBudgetocity Users Love Us!

“I have had this app for over a year now, and I have no regretted using it at all. It had a very easy interface to use, and it has truly helped me budget. Highly recommend this app!”

“This budgeting app rules. I'm able to see what expenses are coming up and I can successfully prepare for the future!”

“Budgetocity has transformed the way I manage my money. The app is intuitive, and the budgeting tips are a game-changer for staying on track!”

“I'm pretty sure I've tried every app but this is the most effective and customizable budget app out there.”

“I've tried several budgeting apps, but none compare to Budgetocity. It's easy to use, and I finally feel in control of my finances!”

“Budgetocity makes budgeting simple and stress-free. I love the custom categories and the clear visual breakdowns of my spending!”

Ready to Take Control of Your Finances?

Join thousands of people who are already using Budgetocity to manage their money better and achieve their financial goals. Get started for free in less than 2 minutes.

Create Your Free Account

Why Choose Budgetocity?

Smart Budget Planning

Our AI-powered system helps you create and maintain realistic budgets based on your income and goals.

Real-time Tracking

Monitor your spending in real-time and get instant insights into your financial habits.

Secure & Private

Bank-level security ensures your financial data is always protected and private.

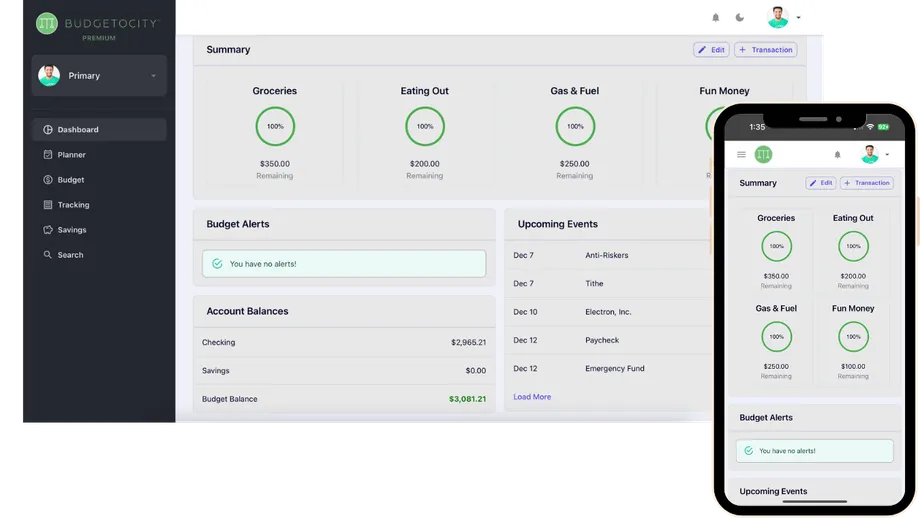

Sync Across Devices

Access your budget from anywhere with our mobile and web apps.